Smart ways to build reliable cash flow from your portfolio in 2025.

A common mistake many people make when searching for income investments is assuming that the highest advertised yield will automatically give them the most reliable monthly paycheck. That approach usually backfires because high yields often come with hidden risks, temporary payouts, or fees that eat away your returns faster than you’d expect.

However, if you can shift your focus from chasing the biggest number to building a diversified mix of income sources that work together, you’ll end up with cash flow that actually shows up every month without keeping you awake at night. The key isn’t finding one perfect product but creating a personal income system where different investments pay you on different schedules, smoothing out your cash flow regardless of what any single holding does.

Instead of gambling on one hot fund or rental property, you can use a toolkit approach that combines several proven income investments. This way, you’re not depending on any single company’s dividend policy, any one property’s tenant, or any particular fund manager’s decisions.

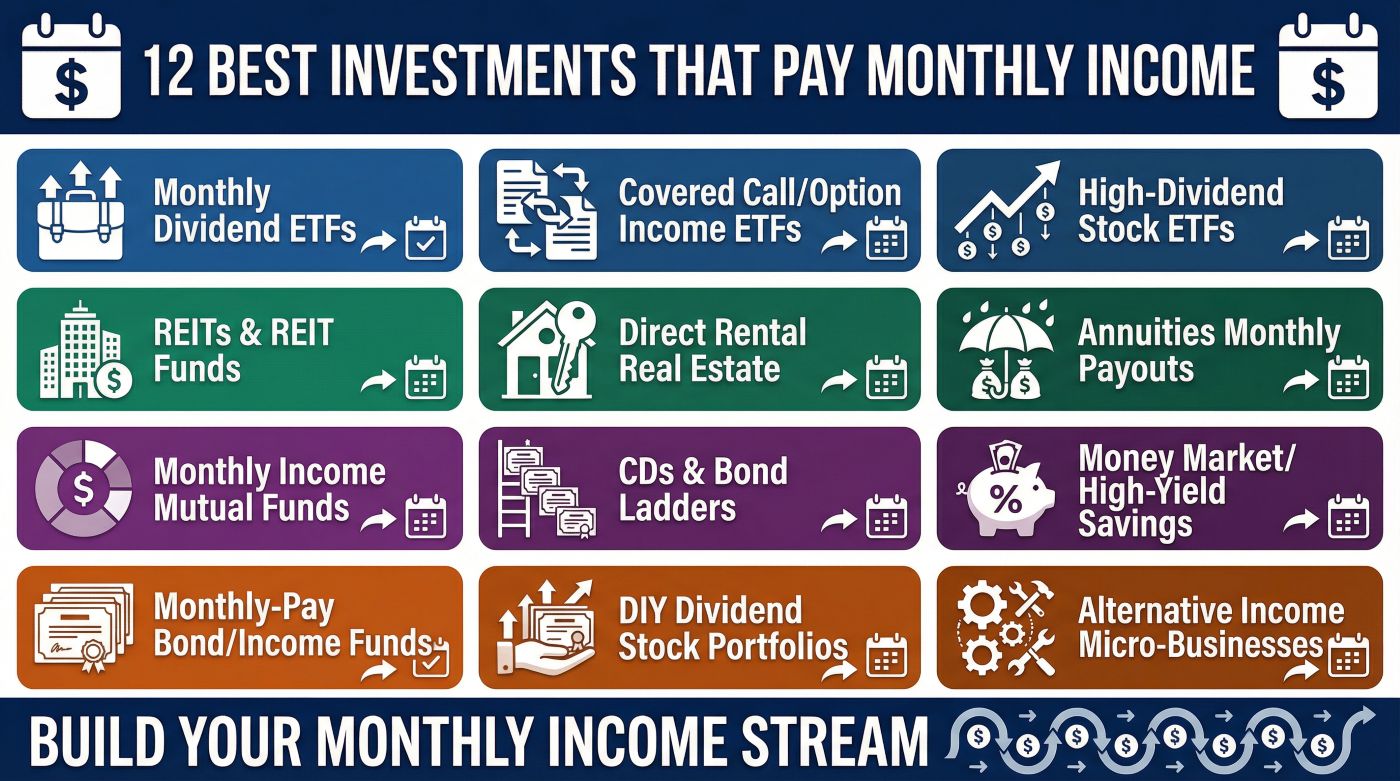

In this guide, you’ll see 12 practical ways to generate monthly income, from straightforward ETFs to real estate and fixed-income tools. This material includes options for different risk levels and shows you how to structure them so cash arrives consistently.

After you review these choices, you’ll have a clear picture of which combinations might work for your situation and how much capital you’d need to hit your monthly income target.

People who think they need to pick just one “perfect” income investment often say they could never build a reliable paycheck from their savings. They’re wrong.

You can separate the hunt for high yield from the goal of steady income. Building many smaller streams that flow together beats relying on one large, risky payout every time.

The approach helps whether you’re just starting to save or you’re already sitting on a portfolio and want to turn it into monthly cash. The core principle is proven across market cycles: diversification smooths income and reduces stress.

Often, the stability from combining three or four modest income sources will give you more peace of mind than chasing one fund paying 10%. Sometimes, far better.

I call this the “paycheck portfolio” method because you’re engineering regular cash flow as if your investments were your employer, as opposed to just hoping dividends show up whenever they feel like it.

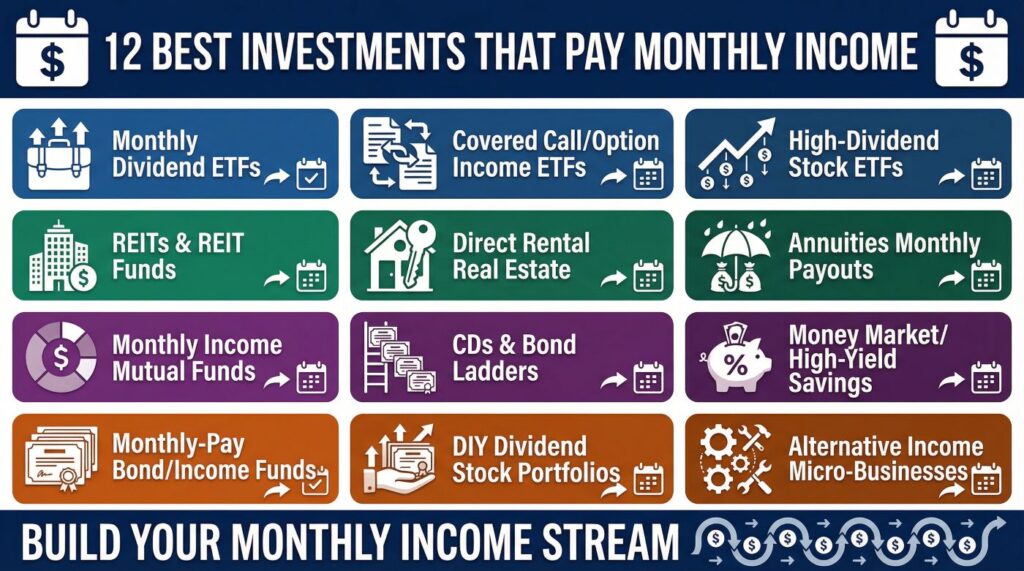

12 best investments that pay monthly income

Below are 12 of the most accessible and widely used ways to generate income on a monthly schedule. Some pay quarterly by default, but you can still create monthly cash flow by holding several with staggered dates or setting up automatic monthly transfers from your brokerage account.

1. Monthly dividend ETFs

If you want cash deposited straight to your account every single month without picking person stocks, monthly dividend ETFs are one of the cleanest tools available.

The WisdomTree U.S. LargeCap Dividend ETF (DLN), WisdomTree U.S. MidCap Dividend ETF (DON), and WisdomTree U.S. SmallCap Dividend ETF (DES) all distribute dividends monthly. These funds hold dividend-paying stocks across many sectors and use screens that emphasize quality and profitability, so you’re not stuck with companies about to cut their payouts.

Fees are low, and everything is transparent.

You typically get yields in the low-to-mid single digits, plus you still join in long-term stock price growth.

Best for: Someone who wants a hands-off, diversified stock fund with predictable monthly cash instead of waiting for quarterly payments.

2. Covered call and option income ETFs

For higher monthly cash flow from equities, covered-call ETFs trade some growth potential for bigger distributions.

JPMorgan Equity Premium Income ETF (JEPI) is the poster child here. It holds large-cap S&P 500 companies and sells call options on them to collect extra premiums, which get paid out monthly.

You still own big, stable companies, but the fund boosts your income by harvesting option premiums.

Payouts can be substantially higher than plain dividend funds, but your upside in roaring bull markets will usually be capped.

Best for: Someone willing to give up some capital appreciation in exchange for aggressive monthly income from stocks.

3. High-dividend stock ETFs

Mainstream high-dividend ETFs pay quarterly, but you can easily turn them into monthly income machines by holding a few with different schedules and setting up automatic monthly withdrawals.

Schwab U.S. Dividend Equity ETF (SCHD) gets a Gold rating from analysts and focuses on quality, wide-moat companies with yields in the high-3% range. Vanguard High Dividend Yield ETF (VYM) tracks larger, stable dividend payers and offers similar reliability.

To get monthly cash, direct all dividends into a money market sweep account and schedule a fixed monthly transfer to your checking account. In good quarters, your cash buffer grows.

In weaker quarters, you draw from the buffer without disrupting your personal spending.

Best for: Core income holding for long-term investors who still want growth alongside dividends.

4. REITs and REIT funds

Real Estate Investment Trusts own or finance properties and must distribute at least 90% of their taxable income to shareholders by law. That rule makes them natural income generators.

You can buy person REITs in sectors like apartments, warehouses, or medical offices, or you can use REIT mutual funds and ETFs for instant diversification. Some REITs pay monthly, many pay quarterly, but the yields are often higher than broad stock market averages because of that 90% payout requirement.

If you want monthly cash, mix a few REITs with different schedules or pair a REIT fund with other income sources and use the same automatic withdrawal strategy.

Best for: Someone comfortable with real estate exposure who wants higher yield in a brokerage or retirement account without the headaches of direct property ownership.

5. Direct rental real estate

Owning a rental property gives you classic monthly rent checks that feel very real and tangible.

You can go with long-term rentals, short-term vacation rentals, or even “house hack” by renting out part of your own home. The upside includes control, potential property appreciation, and valuable tax deductions.

The trade-offs are upfront capital, ongoing maintenance, vacancy risk, and dealing with tenants or property managers.

Rental income can be excellent if you’re in a strong market and manage the property well, but it’s more hands-on than pushing a button to buy an ETF.

Best for: Someone who likes owning hard assets and is willing to handle or outsource the management work.

6. Annuities with monthly payouts

An annuity is an insurance contract where you hand over a lump sum and the insurer commits to paying you on a set schedule, often monthly, for a period you choose or even for life.

Types that fit monthly income include immediate income annuities, deferred income annuities that turn on later, and some fixed indexed or variable annuities with income riders.

The big pro is predictability: you know exactly what you’ll get each month, and you can structure it to last your entire life. The cons are complexity, fees, lower liquidity, and dependence on the insurer’s financial strength.

Best for: Someone who values guaranteed monthly income and is comfortable trading away liquidity and growth potential.

7. Monthly income mutual funds

Some mutual funds are engineered specifically to pay monthly from a diversified blend of stocks and bonds.

The Schwab Monthly Income Funds come in three flavors: SWLRX (Income Payout) targets income from underlying yields, SWKRX (Flexible Payout) tries to maximize payout while protecting your principal, and SWJRX (Target Payout) aims for approximately 5% annual payout spread across monthly payments.

These funds hold a mix of stock and bond funds inside one wrapper and handle all the allocation and distribution logistics for you.

Best for: Someone who wants one-ticket simplicity where a professional manager handles rebalancing and monthly payment mechanics.

8. CDs and bond ladders

Certificates of Deposit and bonds pay interest on schedules, typically semi-annually, but you can build a ladder so something is always maturing or paying out.

Right now, CDs often yield 3% to 4% or more depending on term. Government bond funds tend to yield in a similar range, and municipal bonds can offer tax-exempt interest in the 3.5% to 4.6% range.

To get monthly cash, stagger maturities so you have instruments paying every month, sweep all interest into a central cash account, and set up a fixed monthly transfer. This approach prioritizes preservation and predictability over high yield.

Best for: Conservative investors who want stable, lower-risk income with little volatility.

9. Money market funds and high-yield savings accounts

For maximum safety and liquidity, money market funds and high-yield savings accounts are hard to beat.

Many online banks currently offer around 4% or more on HYSAs, and money market funds offer similar yields. Interest accrues daily and is usually credited monthly.

These accounts work great as the “central hub” of your income system. All your dividends, interest, and other income flows into this account, and you set up one automatic monthly transfer to your checking.

Your buffer grows when income is high and cushions you when income dips.

Best for: Short-term cash, emergency funds, and as the control center for your monthly income machine.

10. Monthly-pay bond and income funds

Many bond funds distribute monthly even though their underlying bonds pay semi-annually. The fund aggregates everything and pays you on a monthly schedule.

Options include investment-grade corporate bond funds, multi-sector bond funds, short-term bond funds, and target-risk income funds. Yields typically land in the 3% to 5% range depending on the fund’s risk profile.

Best for: Adding stability to balance out the volatility from stock-based income sources like dividend funds and covered-call ETFs.

11. DIY dividend stock portfolios

Instead of using an ETF, some investors build their own basket of 20 to 40 dividend stocks, staggering payment dates to create monthly cash flow.

You might mix higher-yield stocks with dividend-growth leaders. Funds like Vanguard Dividend Appreciation ETF (VIG) focus on companies that grow dividends over time, giving you rising income plus solid total returns.

Building your own portfolio takes more research and monitoring, but gives you finish control over sector exposure, tax placement, and payout timing.

Best for: Hands-on investors who enjoy research and want full control of their income strategy.

12. Alternative income micro-businesses

Some income “investments” behave more like semi-passive businesses that generate monthly cash, such as vending machines, laundromats, storage units, or equipment rentals.

For example, a 10-machine vending route costing around $30,000 might generate roughly $3,000 per month in gross revenue. These options need upfront capital and some ongoing effort, but they can produce steady monthly income once established.

Best for: Someone comfortable blending sweat equity with capital to build a tangible income stream.

My top pick and how to use this list

If you’re just starting out and want the simplest path to monthly investment income, your best bet is combining a core of diversified dividend and bond funds that either pay monthly or can be structured to deliver monthly cash through automatic withdrawals.

A practical starting setup might look like this: one monthly dividend ETF for straightforward stock income, one or two quality high-dividend ETFs like SCHD or VYM for long-term growth, and a monthly bond fund or high-yield savings account for stability and a cash buffer.

From there, layer in other options based on your situation. Add REITs if real estate appeals to you, consider an annuity if you want guaranteed lifetime income, or buy a rental property if you like tangible assets and don’t mind the management work.

The real power comes from thinking of your investments as a “paycheck portfolio” where many income streams flow into one central account and you pay yourself a fixed amount every month. In strong years, excess cash piles up in your buffer.

In weak years, you tap the buffer instead of slashing your budget overnight.

Start with one or two ideas from this list that match your risk tolerance and timeline. Learn the details, start small, and add more sources as you see how the income behaves through different market conditions.

You’re not trying to be perfect on day one.

You’re building a system that gets stronger and smoother with each piece you add.

Frequently asked questions

What is a realistic yield to target for monthly income?

With a balanced, diversified portfolio, most investors target something in the 3% to 5% annual yield range. Higher yields exist with covered-call ETFs, REITs, and high-yield bonds, but those come with more volatility or risk of payout cuts.

A mix of dividend funds, bond funds, and cash usually lands you somewhere in that middle range without excessive risk.

How much do I need invested to get $1,000 per month?

At a 4% yield, you need roughly $300,000 invested. At 5%, around $240,000. In reality, you’ll likely use a combination of yield and systematic withdrawals, so total return matters more than just distributions.

The 4% rule suggests you can withdraw 4% annually from a balanced portfolio with decent odds it lasts 30 years.

Are monthly income ETFs safer than person dividend stocks?

Monthly income ETFs spread risk across dozens or hundreds of companies, so one dividend cut barely registers. Funds like the WisdomTree series or SCHD use quality screens to favor financially healthy companies.

Individual stocks can work great, but you need to do more homework, and your risk is concentrated if something goes wrong with one holding.

How do taxes work on monthly income?

In taxable accounts, stock dividends can be “qualified” (lower tax rate) or “ordinary” (taxed as regular income). REIT distributions and bond interest are usually taxed at ordinary income rates.

CDs and high-yield savings pay interest taxed as ordinary income.

In tax-advantaged accounts like IRAs, income grows tax-deferred and you pay taxes on withdrawals according to the account rules. Many investors hold bonds and REITs in retirement accounts and keep qualified dividend stocks in taxable accounts for better tax efficiency.

Can I live entirely off monthly income without touching principal?

It’s possible with large enough portfolios, but it’s not always optimal. Chasing pure income can push you into riskier, high-yield investments that may not be suitable.

Many financial planners prefer a total-return approach where you take steady withdrawals based on your portfolio’s overall growth and income combined, accepting that some years you’ll consume principal and other years you’ll grow it.

This method often provides more flexibility and better long-term results than strict “live off the income only” strategies.

How can I smooth quarterly payouts into steady monthly cash?

You don’t need every holding to pay monthly. Direct all dividends, interest, and other income into a single money market fund or high-yield savings account.

Build a three-to-twelve-month cash buffer in that account.

Set up an automatic fixed monthly transfer from that account to your checking. When payouts are strong, the buffer grows.

When payouts are light or irregular, you draw from the buffer.

This keeps your personal cash flow smooth even when investment distributions arrive at odd times.

What’s the biggest mistake people make with monthly income investing?

Chasing the highest yield without looking at the underlying risk. Funds or investments advertising 8%, 10%, or higher yields often come with hidden risks like leverage, payout cuts during downturns, or high fees.

A more sustainable approach focuses on building a diversified mix of moderate-yield investments that work together, as opposed to betting everything on one high-yield product that might not deliver when you need it most.

References

[1] Morningstar analysis of top high-dividend ETFs and WisdomTree monthly dividend funds.

[2] 24/7 Wall St. discussion of SCHD, JEPI, SPHD, and SDIV as income ETFs.

[3] NerdWallet overview of best investments, including typical yields for savings, CDs, bonds, and stock indexes.

[4] Unbiased.com guide to 12 investments that pay monthly income, including REITs, annuities, CDs, HYSAs, mutual funds, bonds, and choice income ideas.

[5] Schwab Asset Management description of Schwab Monthly Income Funds and their payout policies.