M1 Plus has impressed me with how it simplifies complex investing decisions while giving you professional-level tools at a fraction of traditional brokerage costs. The platform combines automated portfolio management with premium features like low-cost margin lending and high-yield cash accounts.

If you’re managing retirement savings, handling a 401(k) rollover, or building wealth through disciplined long-term investing, M1 Plus delivers real value without the overwhelming complexity that typically comes with tax-advantaged accounts.

You Also Might Be Interested In:

What M1 Plus Actually Gives You

M1 Plus is the premium subscription tier from M1 Finance. You pay a monthly fee (typically $3-5 depending on promotions) to access features that go beyond their free platform.

The base M1 Finance platform already handles commission-free trading, automated rebalancing, and fractional shares. You don’t need to pay anything to use those core features.

M1 Plus adds specific premium benefits that matter most to serious investors with larger account balances.

The main M1 Plus benefits include:

- Margin borrowing at significantly reduced rates (often 4-5% compared to 7-9% at traditional brokerages)

- No account minimum requirements

- Access to borrowing lines for portfolio leverage

- Enhanced cash management features

- Priority access during high-traffic periods

The subscription makes financial sense when you have a specific use case for these premium features. For most people considering this m1 plus review, the decision comes down to whether you’ll actually use margin lending.

Understanding Margin Access and Why It Matters

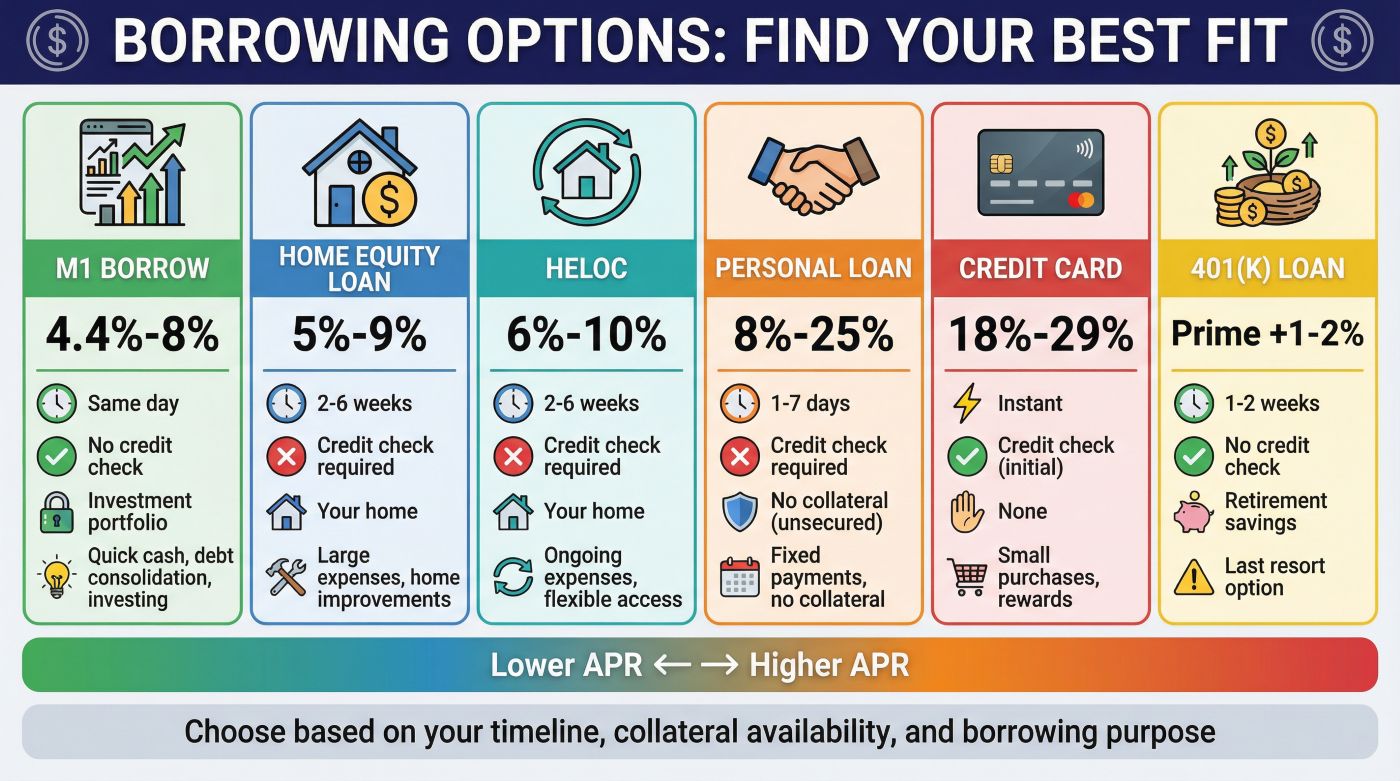

Margin let’s you borrow money against your existing portfolio holdings to invest more capital. This amplifies both potential gains and losses, so you need to understand exactly what you’re getting into.

M1 Plus offers some of the cheapest margin rates in the brokerage industry. At traditional firms, you might pay 8-9% annually to borrow against your portfolio.

M1 Plus typically charges 4-5%, though rates vary based on market conditions.

Here’s a concrete example. You have $75,000 in your investment account.

With M1 Plus margin access, you can borrow an extra $37,500 at around 4.5% interest.

That’s roughly $1,688 in annual interest costs.

Compare that to a traditional brokerage charging 8% on the same borrowed amount. You’d pay $3,000 annually.

The M1 Plus subscription costs maybe $60 per year, but saves you over $1,300 in interest charges.

The math only works at certain account sizes though. If you have $10,000 invested and borrow $5,000, you’re paying $225 in annual interest at 4.5%.

The subscription fee becomes a larger percentage of your total costs, and the benefit shrinks considerably.

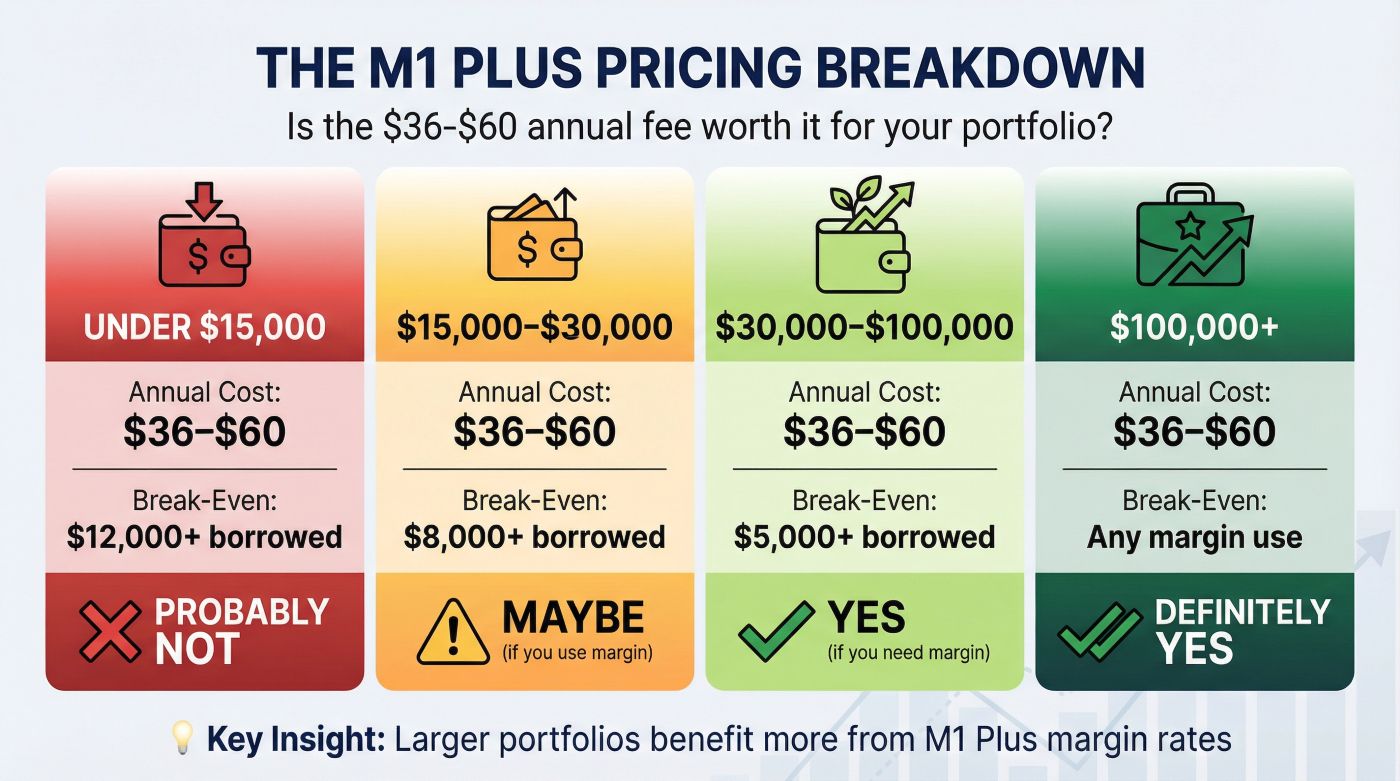

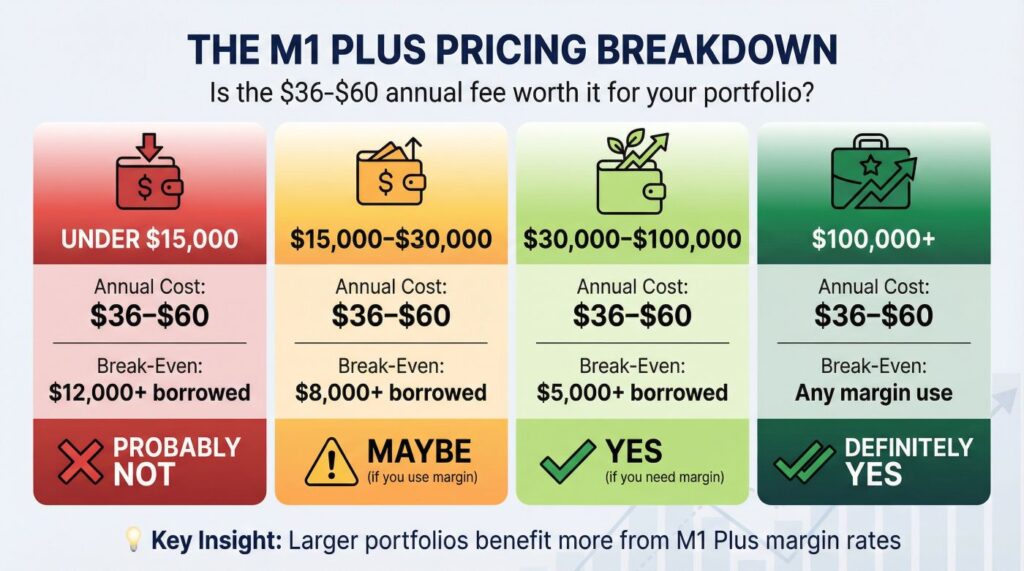

The M1 Plus Pricing Breakdown

| Account Size | Annual M1 Plus Cost | Break-Even Margin Amount | Worth It? |

| Under $15,000 | $36–$60 | $12,000+ borrowed | Probably not |

| $15,000–$30,000 | $36–$60 | $8,000+ borrowed | Maybe, if you use margin |

| $30,000–$100,000 | $36–$60 | $5,000+ borrowed | Yes, if you need margin |

| $100,000+ | $36–$60 | Any margin use | Definitely yes |

This assumes you’re actually using margin for planned investment purposes. If margin stays theoretical and you never tap it, M1 Plus costs you money without returning value.

Who Benefits Most From M1 Plus

You’re managing irregular income as a self-employed professional or business owner. Cash flow varies month to month.

M1 Plus margin gives you a financial buffer without forcing you to liquidate long-term positions.

You can tap borrowed funds during slow months and repay when business picks up, all while keeping your portfolio intact and compounding.

You’ve recently completed a 401(k) rollover and you’re sitting on substantial retirement savings. M1 Plus removes the account minimum and gives you sophisticated portfolio management tools.

The platform’s pie-based interface let’s you construct a diversified portfolio across dozens of positions without paying management fees to a financial advisor.

You’re targeting early retirement through aggressive savings and disciplined investing. The FIRE community has embraced M1 Finance specifically because it automates the tedious parts of portfolio management.

M1 Plus adds margin capability for opportunistic investing during market corrections, letting you deploy extra capital when prices drop without disrupting your regular contribution schedule.

You’re approaching retirement age and managing many accounts across different tax treatments. The complexity of coordinating Traditional IRAs, Roth IRAs, and taxable brokerage accounts creates real stress.

M1 Plus consolidates everything under one intuitive platform with automated tax-loss harvesting built in.

The Complete Feature Set

Automated Portfolio Rebalancing

Your target allocation stays consistent without manual intervention. If you want 70% stocks and 30% bonds, M1 automatically adjusts your portfolio back to those percentages as market movements shift things around.

This happens seamlessly with every deposit you make.

Fractional Share Purchasing

You can buy partial shares of expensive stocks. Want to own Amazon or Google but can’t afford full shares?

M1 let’s you purchase fractional amounts, so every dollar you deposit gets invested immediately according to your target percentages.

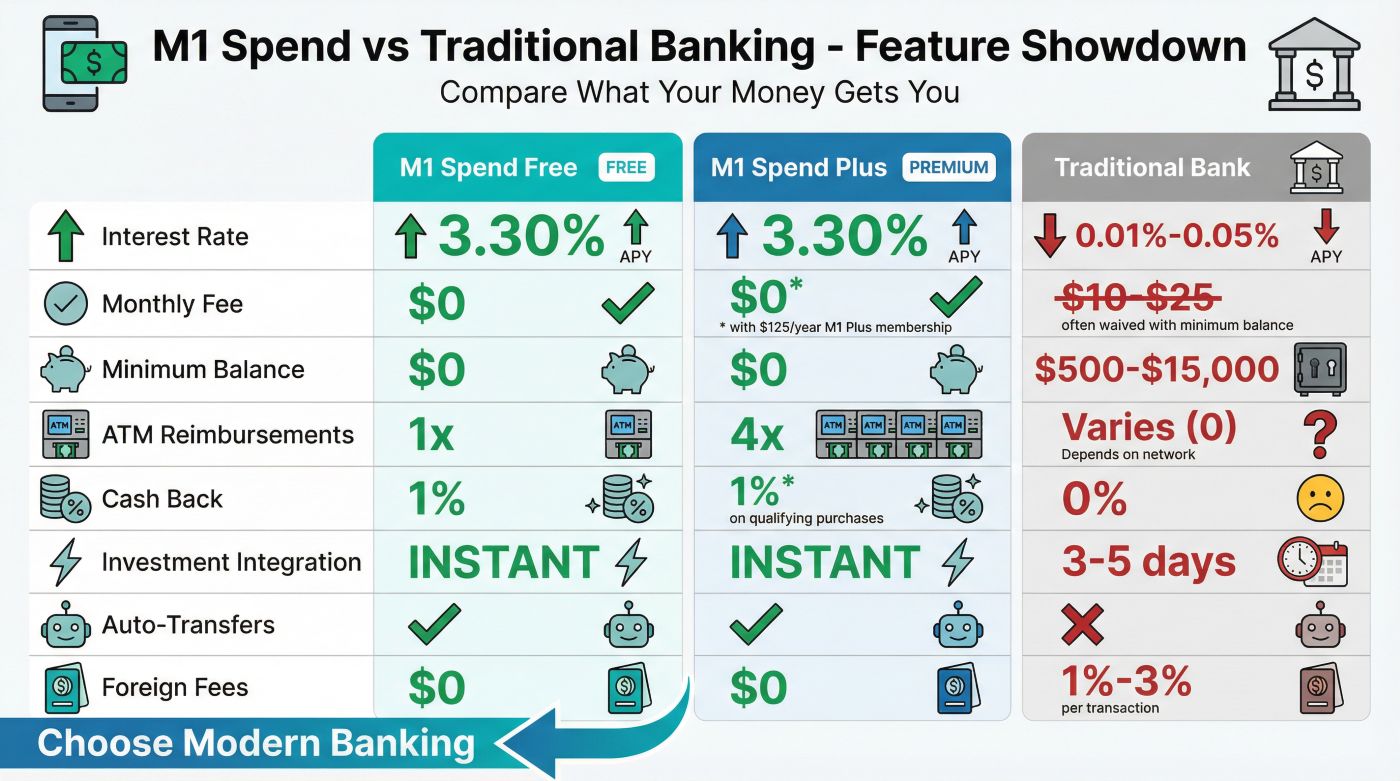

High-Yield Cash Account Integration

M1 Plus connects to their cash management system offering competitive APY rates (currently around 4%). Your uninvested cash earns meaningful returns while you decide on allocations, instead of sitting in a zero-interest sweep account like traditional brokerages offer.

Dynamic Spending Account Features

You can link a debit card directly to your investment account, creating a sophisticated cash management system. This works particularly well for self-employed professionals who need flexible access to funds without maintaining separate checking and investment accounts.

Tax-Efficient Selling

When you need to liquidate positions, M1 automatically prioritizes which shares to sell for optimal tax treatment. The platform realizes losses first to offset gains, then favors long-term capital gains over short-term gains.

You don’t file special forms or ask this treatment.

It happens automatically.

Real-World Applications for Different Account Types

Traditional and Roth IRA Management

M1 Plus handles both account types within the same platform. You can run different investment strategies for each account based on your tax situation and timeline.

The automated rebalancing works independently for each account, so your aggressive Roth IRA allocation doesn’t interfere with your more conservative Traditional IRA approach.

Taxable Brokerage Accounts

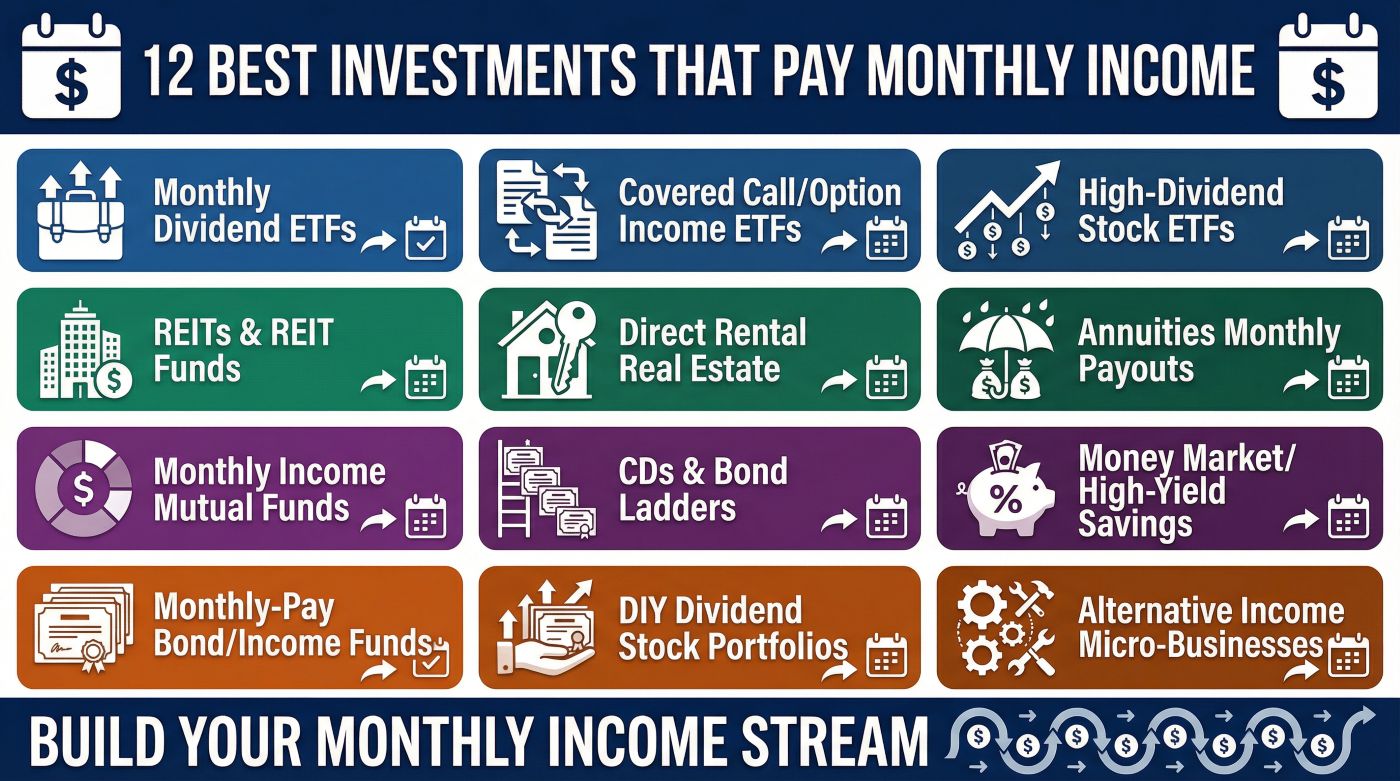

Tax-loss harvesting becomes completely automated. M1 scans your portfolio daily for positions showing losses that can offset gains elsewhere. This tax optimization happens without you watching market movements or timing sales manually.

401(k) Rollover Accounts

Rolling over an old employer 401(k) into M1 Plus gives you dramatically more investment options than the typical fund menu you had before. You can construct a portfolio of specific stocks and ETFs matching your exact preferences instead of choosing from 15-20 pre-selected mutual funds.

Comparing M1 Plus to Traditional Brokerages

Most people reading this m1 plus review are comparing it against staying with Fidelity, Charles Schwab, or Vanguard. Here’s what actually differs.

Trading Execution

M1 uses scheduled trading windows instead of real-time execution. Your orders process during specific times each day (typically morning for most accounts).

This constraint actually helps long-term investors by preventing impulsive emotional trading during market volatility.

Traditional brokerages offer real-time execution, which matters for active traders but provides little benefit for buy-and-hold investors. If you’re building retirement wealth over decades, trading at 9:30 AM versus 2:00 PM makes zero practical difference.

Investment Selection

M1 Plus offers stocks and ETFs. You won’t find mutual funds or options trading.

For retirement-focused investors, this limitation barely matters.

ETFs provide the same diversification as mutual funds with better tax efficiency and lower expense ratios.

Traditional brokerages offer everything including mutual funds, options, futures, and complex derivatives. You’re paying for access to investment vehicles you probably shouldn’t be using anyway.

Customer Support

M1 provides email and online support. Phone support exists but operates with limited hours compared to major brokerages.

If you need extensive hand-holding, traditional firms offer more comprehensive support systems.

Most M1 Plus users find the platform intuitive enough that support needs rarely arise. The pie-based portfolio interface makes allocation changes visually simple.

Account Fees and Minimums

M1 Plus charges one flat subscription fee and nothing else. No commission on trades, no fees for rebalancing, no charges for fractional shares, no account maintenance fees.

Traditional brokerages have eliminated most trading commissions, but often charge fees for other services, paper statements, wire transfers, account closures, or returned deposits. These nickel-and-dime charges add up over years.

Addressing the Complexity of Tax-Advantaged Accounts

The confusion around Traditional IRAs, Roth IRAs, and 401(k)s causes real paralysis for many investors. You’re earning good income but can’t figure out which account type to prioritize.

Should you max out your Traditional IRA for the immediate tax deduction?

Or fund a Roth IRA for tax-free growth?

M1 Plus doesn’t answer those questions for you, but it removes the execution complexity once you decide. You can open both account types, fund them simultaneously, and run completely different investment strategies in each one.

The platform handles the administrative overhead while you focus on the actual investing decisions that matter.

This simplification matters enormously when you’re managing many accounts across different tax treatments. Traditional brokerages often segregate accounts into separate logins or interfaces.

M1 consolidates everything into one dashboard with clear visibility across your entire financial picture.

The Psychology of Automated Investing

Market volatility triggers emotional decisions that destroy wealth. You see your portfolio drop 15% during a correction and panic-sell at the worst possible time.

Then you miss the recovery because you’re too scared to reinvest.

M1 Plus removes these psychological triggers through automation and constrained trading windows. Your portfolio continues rebalancing according to your predetermined strategy regardless of market conditions.

You can’t panic-sell at 2 AM because you can’t execute trades outside scheduled windows.

The pie-based interface reinforces long-term thinking. You’re looking at target allocations and percentages instead of obsessing over daily dollar fluctuations.

This subtle psychological shift keeps you focused on your investment strategy as opposed to market noise.

Limitations You Need to Understand

No Options Trading

To sell covered calls or buy protective puts, M1 Plus won’t accommodate that strategy. You need a traditional brokerage offering options access.

Limited Cryptocurrency

M1 offers only three specific cryptocurrencies. If crypto exposure is important to your portfolio strategy, you’ll need to use Coinbase or another dedicated crypto platform alongside M1.

Restricted Trading Windows

You can’t day trade on M1. The platform explicitly discourages active trading through its scheduled execution system.

To trade often, M1 Plus will frustrate you.

Margin Risk

Borrowing money to invest amplifies losses just as much as gains. A leveraged portfolio that drops 30% during a recession creates real financial damage.

Margin calls can force you to liquidate positions at terrible times.

Using M1 Plus margin needs intellectual honesty about your risk tolerance and investment timeline. If you’re within 10 years of retirement, aggressive margin use could derail your entire financial plan.

Making the Upgrade Decision

Start with your account size. If you have less than $25,000 invested, M1 Plus probably costs more than it returns unless you have a specific planned use for margin borrowing.

Between $25,000 and $100,000, the decision depends on whether you’ll actually use the premium features. Write down specifically how you plan to use margin. If you can’t articulate a clear use case beyond vague ideas about leverage, stay with the free version.

Above $100,000, M1 Plus makes increasing financial sense. The margin rate differential compounds into meaningful savings, and the premium features justify the minimal subscription cost.

Consider your investment approach. Are you a hands-off buy-and-hold investor who wants automation?

M1 Plus fits perfectly.

Do you enjoy active trading and market timing? This platform will frustrate you.

Think about your complexity tolerance. Does managing many accounts across different platforms create stress?

M1 Plus consolidates everything under one intuitive system.

Are you comfortable with your current brokerage setup? Switching carries hassle costs that might outweigh M1 Plus benefits.

Getting Started With M1 Plus

Opening an account takes about 10 minutes. You’ll provide standard information like your Social Security number, employment details, and funding source.

M1 verifies your identity and usually approves accounts within one business day.

You can start with the free version and upgrade to M1 Plus later. This let’s you test the platform’s interface and confirm it matches your investing style before committing to the subscription.

Funding happens through bank transfer (ACH), wire transfer, or 401(k) rollover. ACH transfers take 3-5 business days but cost nothing.

Wire transfers arrive same-day but usually carry fees from your bank.

The pie-based portfolio construction looks different from traditional brokerage interfaces. You create “slices” representing different investments and assign percentage allocations to each slice.

M1 automatically purchases fractional shares to match your target allocations whenever you deposit money.

The Bottom Line on M1 Plus Value

This m1 plus review comes down to a simple calculation. Does the subscription cost less than the value you receive from premium features?

For investors with substantial account balances who will use margin lending strategically, M1 Plus delivers clear financial value. The interest rate savings alone justify the subscription many times over.

For smaller accounts or investors who don’t need leverage, the free M1 Finance platform provides everything required for successful long-term investing. You’re not missing essential features by staying on the free tier.

The real power of M1 comes from its automated rebalancing, tax-efficient selling, and forced discipline through constrained trading windows. Those benefits exist whether you pay for Plus or not.

M1 Plus adds optionality and enhanced features, but the foundation of successful investing stays consistent: regular contributions to a diversified portfolio held for decades. The subscription tier can’t shortcut that basic requirement.

Ready to Start Building Your Portfolio?

Open your M1 Finance account here and begin with their free platform. Test the pie-based interface and automated rebalancing before deciding whether M1 Plus premium features match your investing needs.