When I first heard about M1 Borrow, I was honestly skeptical. A line of credit backed by your investment portfolio?

No credit check?

No loan officer breathing down your neck? It sounded too good to be true.

But after digging into the details, I found that M1 has created something genuinely useful for investors who need quick access to cash without liquidating their holdings.

The rates are competitive, the process is simple, and you can use the funds for just about anything. That said, margin loans come with real risks that you need to understand before borrowing a single dollar.

Let me walk you through everything you need to know.

You Also Might Be Interested In:

What M1 Borrow Actually Is

M1 Borrow gives you a line of credit based on the value of your investment portfolio. You can borrow up to 40% of your account value as a standard M1 member, or up to 50% if you have M1 Plus.

The way it works is straightforward. Your investments serve as collateral for the loan.

M1 doesn’t run a credit check.

They don’t ask what you need the money for. Once your portfolio reaches $2,000, you can turn on M1 Borrow and have cash in your bank account within minutes.

You only pay interest on what you borrow. There’s no fixed repayment schedule.

You can pay back the loan whenever you want, or just keep making interest payments indefinitely.

This type of loan is called a margin loan in the investment world. The key difference between M1 Borrow and traditional margin accounts is that M1 makes it dead simple to access and manage.

The Interest Rates and Costs

Here’s where this m1 borrow review gets interesting. The rates are actually pretty good compared to most borrowing options.

Standard M1 members pay 8% APR. That’s already lower than most credit cards and many personal loans.

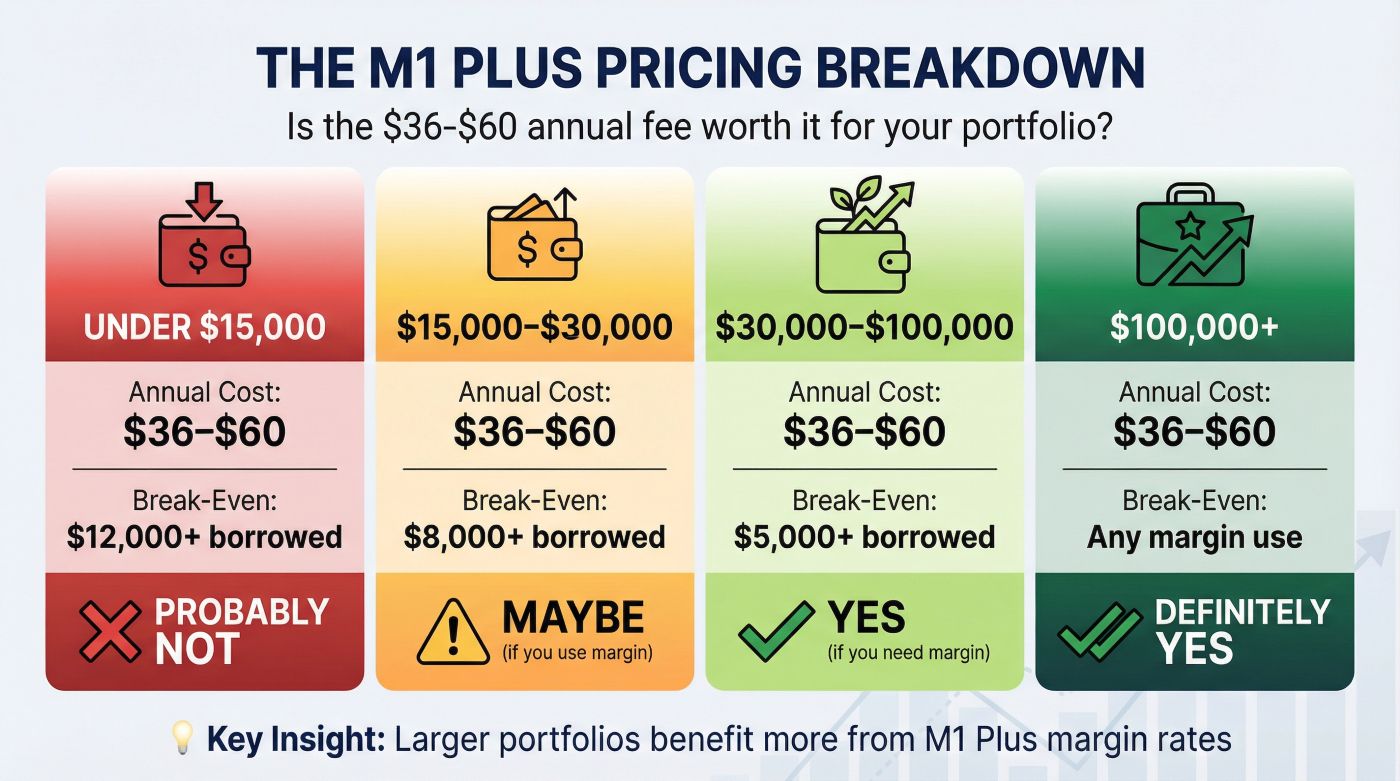

M1 Plus members pay 6.5% APR. The M1 Plus subscription costs $3 per month, but it’s waived if your portfolio is over $10,000. So if you have a decent-sized account, you get the lower rate for free.

M1 also runs promotions. As I’m writing this m1 borrow review, they’re offering 4.40% APR for the first 12 months for new borrowers.

That’s genuinely competitive with home equity loans, and you don’t have to put your house up as collateral.

There are no origination fees. No application fees.

No early repayment penalties.

You just pay the daily interest on your outstanding balance, which gets charged to your account monthly.

Let me put this in perspective. If you borrow $10,000 at 6.5% APR, you’re paying about $54 per month in interest.

Compare that to the average credit card at 20%+ APR, where you’d pay $166 per month just in interest.

How to Set Up M1 Borrow

Getting started is easier than opening a new credit card.

First, you need an M1 Invest account with at least $2,000 in it. If you’re already an M1 customer, you just need to enable the Borrow feature in your account settings.

Second, you need to decide if you want M1 Plus for the lower rate. If your portfolio is under $10,000, you’ll pay $3/month for Plus.

If it’s over $10,000, Plus is free and you automatically get the 6.5% rate.

Third, you activate M1 Borrow. The system calculates how much you can borrow based on your portfolio value and composition.

Some investments count more toward your borrowing power than others.

Index funds and blue-chip stocks carry more weight than volatile small-cap stocks.

Once activated, you can transfer money from your Borrow line to your M1 Spend checking account or to an external bank account. The whole process takes minutes.

The Real Benefits

The speed alone makes M1 Borrow worth considering. When you need cash quickly, waiting weeks for a traditional loan approval feels like torture.

With M1, you can have money in hand the same day.

The flexibility is another major advantage. You’re not locked into fixed monthly payments.

Pay back what you can, when you can.

Need to reborrow? Just transfer more funds.

The line of credit stays open as long as you maintain your portfolio.

For debt consolidation, M1 Borrow can save you serious money. Let’s say you have $15,000 in credit card debt at 22% APR.

You’re paying $275 per month just in interest.

If you borrow $15,000 from M1 at 6.5%, you pay $81 per month. That’s a $194 monthly savings without changing anything else.

You can also use M1 Borrow strategically for investing. Some people borrow against their long-term holdings to fund a down payment on rental property.

Others use it to invest in opportunities that come up suddenly.

The interest you pay might be less than the returns you generate.

One benefit that doesn’t get talked about enough is tax efficiency. When you borrow against your portfolio, you don’t trigger capital gains taxes.

If you sold $20,000 worth of investments to raise cash, you might owe thousands in taxes.

Borrowing that same $20,000 costs you nothing in taxes, just interest.

Check current M1 Borrow rates and see how much you could save

The Risks You Need to Understand

This wouldn’t be a finish m1 borrow review without addressing the downsides.

Margin calls are the biggest risk. If your portfolio value drops significantly, M1 may require you to either deposit more cash, add more securities, or pay down part of your loan. If you don’t respond quickly enough, M1 can sell your investments to cover the loan.

Let me give you a concrete example. Say you have a $50,000 portfolio and borrow $20,000 (40% of your portfolio value).

If the market crashes and your portfolio drops to $35,000, your loan-to-value ratio shoots up to 57%.

That’s above M1’s threshold. You’d get a margin call requiring immediate action.

The math gets worse if you’re using leverage to invest more. If your portfolio drops 30%, but you’re leveraged, your actual losses could be 50% or more.

Leverage magnifies both gains and losses.

Market volatility exposure is constant. During stable markets, M1 Borrow feels safe and easy. During crashes, it can become a serious problem fast.

The 2020 COVID crash, the 2022 bear market, and other sudden drops can trigger margin calls even for conservative investors.

You can’t borrow against all account types. M1 Borrow only works with taxable brokerage accounts. You can’t borrow against your IRA or Roth IRA.

This limits the strategy for people who keep most of their wealth in retirement accounts.

The borrowing limit caps at 50%. Some brokers offer higher loan-to-value ratios. M1 keeps it conservative, which is probably smart, but it does limit how much you can access.

Joint account holders can’t use M1 Borrow together. Only the primary account holder can borrow. This creates complications for married couples who invest jointly.

Comparing Your Options

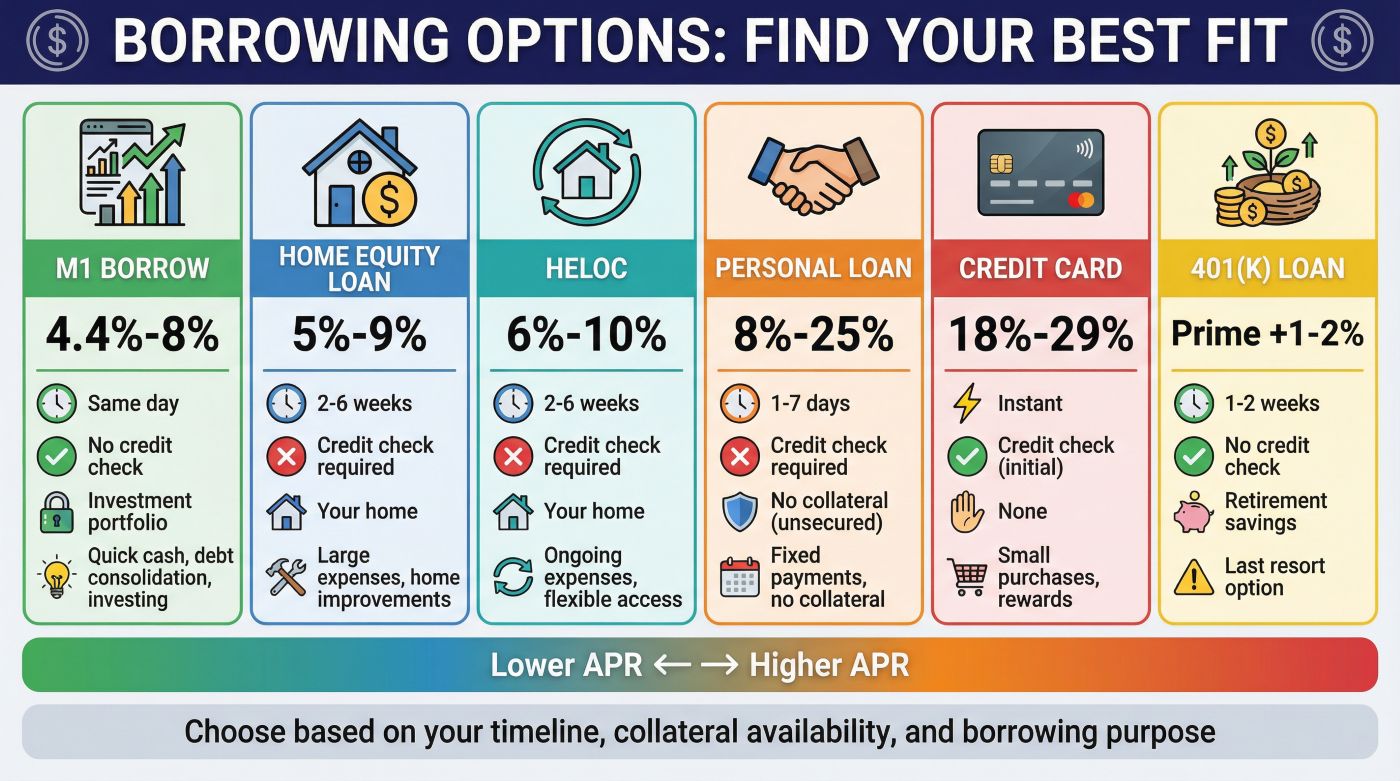

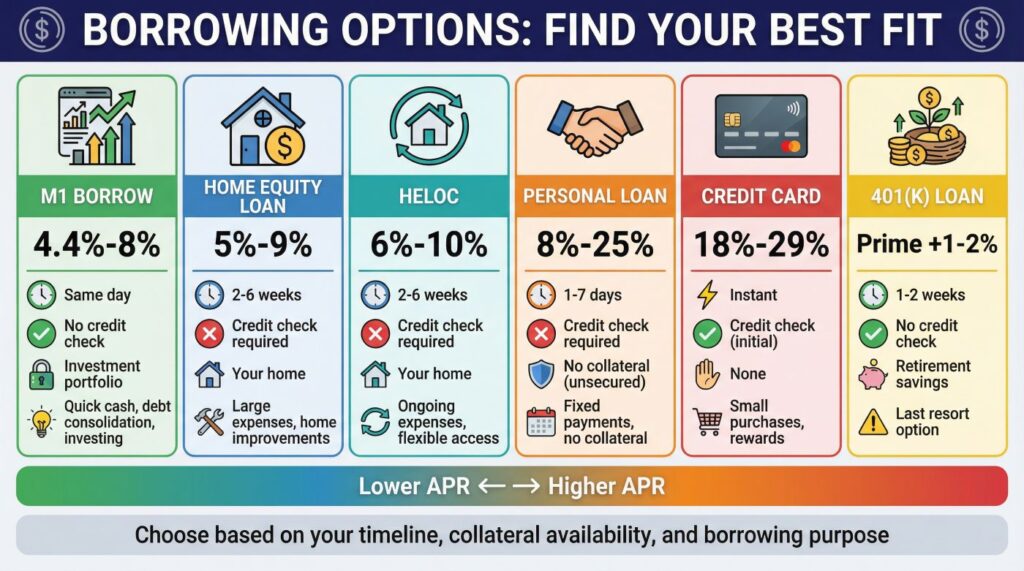

Let me show you how M1 Borrow stacks up against other common borrowing methods.

| Borrowing Option | Typical APR | Approval Time | Credit Check | Collateral Required | Best For |

| M1 Borrow | 4.4%, 8% | Same day | No | Investment portfolio | Quick cash needs, debt consolidation, investing |

| Home Equity Loan | 5%, 9% | 2-6 weeks | Yes | Your home | Large expenses, home improvements |

| HELOC | 6%, 10% | 2-6 weeks | Yes | Your home | Ongoing expenses, flexible access |

| Personal Loan | 8%, 25% | 1-7 days | Yes | None (unsecured) | No collateral available, fixed payments |

| Credit Card | 18%, 29% | Instant | Yes (initially) | None | Small purchases, rewards earning |

| 401(k) Loan | Prime + 1-2% | 1-2 weeks | No | Your retirement savings | When no other option exists |

The table makes it clear that M1 Borrow offers a unique combination of low rates, fast access, and no credit check. You won’t find that combination anywhere else.

Home equity loans offer similar rates but require weeks of paperwork and put your house on the line. Personal loans are faster but come with much higher rates, especially if your credit isn’t perfect.

Credit cards are convenient but absurdly expensive for anything beyond short-term borrowing.

Smart Ways to Use M1 Borrow

For people approaching retirement, M1 Borrow can help you avoid selling investments during market downturns. Let’s say you’re 60 and need $30,000 for a new roof.

The market just dropped 20%.

Instead of selling at a loss, you borrow against your portfolio at 6.5% and repay it when the market recovers. You avoid locking in losses and triggering unnecessary capital gains taxes.

For self-employed professionals, M1 Borrow works great for smoothing out irregular income. You might have a $20,000 tax payment due in April but your big client doesn’t pay until May.

Borrow the $20,000, pay your taxes on time, then repay the loan when your invoice gets paid.

You avoid penalties and keep your business running smoothly.

For younger investors chasing financial independence, M1 Borrow can fund opportunities that speed up wealth building. Maybe you find a great deal on a rental property but need $15,000 for the down payment before your next paycheck.

Borrow it, secure the property, then repay the loan over time as rental income comes in.

For mid-career professionals with 401k rollovers, M1 Borrow provides bridge financing during transitions. When you leave a job and roll your 401k into an IRA at M1, you might have a gap in cash flow.

Borrow against your newly rolled-over investments to cover expenses while you settle into your new role.

The key to all these strategies is having a clear repayment plan. M1 Borrow works beautifully for temporary cash needs. It becomes dangerous when you borrow without a plan to pay it back.

Open your M1 Finance account and get access to portfolio-backed borrowing

Who Should Skip M1 Borrow

Not everyone should use margin loans.

If your portfolio is small or heavily weighted toward volatile stocks, the margin call risk is too high. A $5,000 portfolio invested in penny stocks could trigger a margin call from one bad earnings report.

If you lack discipline with debt, M1 Borrow will hurt you. The ease of borrowing makes it tempting to keep taking out more without paying it back.

Before you know it, you’re paying hundreds per month in interest on a loan that’s grown out of control.

If you’re close to retirement and can’t afford to lose principal, margin loans introduce unnecessary risk. You’ve spent decades building your nest egg.

Putting it at risk for a margin loan in your 60s makes little sense unless you have very specific circumstances.

If you need a large sum for many years, a traditional loan probably makes more sense. M1 Borrow shines for flexible, shorter-term needs. If you’re financing a $50,000 kitchen renovation over 10 years, a home equity loan will likely be cheaper overall.

How M1 Borrow Fits Into Your Financial Plan

I see M1 Borrow as a tool, not a strategy. Used correctly, it gives you financial flexibility without forcing you to sell investments at bad times or rack up high-interest credit card debt.

Think of it like a financial shock absorber. Life throws unexpected expenses at you.

Medical bills.

Home repairs. Investment opportunities.

Business needs. M1 Borrow let’s you handle these without disrupting your long-term investment plan.

The psychological benefit matters too. Knowing you have access to low-cost credit if you need it reduces financial stress.

You can keep your money invested for the long haul without worrying about liquidity.

That said, you need to respect the risks. Keep your borrowing below 30% of your portfolio value to maintain a safety cushion.

Choose stable, diversified investments as collateral as opposed to speculative stocks.

Have a repayment plan before you borrow.

If you approach M1 Borrow with discipline and clear thinking, it becomes one of the most useful financial tools available to investors.

The Final Verdict on M1 Borrow

After researching for this m1 borrow review, I can say that M1 has built something genuinely useful. The combination of low rates, zero paperwork, and instant access creates a borrowing experience that beats traditional loans by a mile.

The 6.5% rate for M1 Plus members is hard to beat. When you factor in the tax advantages of not selling investments and the flexibility of the repayment terms, M1 Borrow makes financial sense for many situations.

The risks are real but manageable. Stay below the most borrowing limit.

Keep your portfolio diversified and reasonably stable.

Have a repayment plan. Follow these guidelines and margin calls become unlikely.

For investors with decent-sized portfolios who need occasional access to cash, M1 Borrow delivers exactly what it promises. No other broker makes margin lending this accessible or affordable.

You just need to be honest with yourself about whether you can handle the responsibility. If you can, M1 Borrow might be exactly what your financial toolkit needs.

Start building your M1 portfolio today and unlock low-cost borrowing power